WASHINGTON, D.C. – Nancy Pelosi’s stock portfolio achieved remarkable returns in 2024, with performance figures that substantially outpaced major investment benchmarks and professional money managers. According to White House Press Secretary Karoline Leavitt and multiple financial tracking sources, Pelosi’s portfolio grew 70% in 2024, though some sources report a more conservative 54% return. Even using the lower figure, her performance significantly exceeded major market benchmarks and professional investors.

Performance Comparison Analysis

Market Benchmarks Comparison:

- Nancy Pelosi Portfolio: 70% (primary estimate) / 54% (conservative estimate)

- S&P 500 Index: 25.0% total return

- Hedge Fund Industry Average: 11.3% asset-weighted return

- Warren Buffett’s Berkshire Hathaway: Historical 19.9% annual average

The performance differential is striking. Pelosi’s portfolio returns were nearly three times higher than the S&P 500’s already strong 25% gain and more than six times higher than the average hedge fund return of 11.3%. Even compared to Warren Buffett’s legendary long-term track record of 19.9% annual returns, Pelosi’s 2024 performance was substantially higher.

Strategic Investment Approach

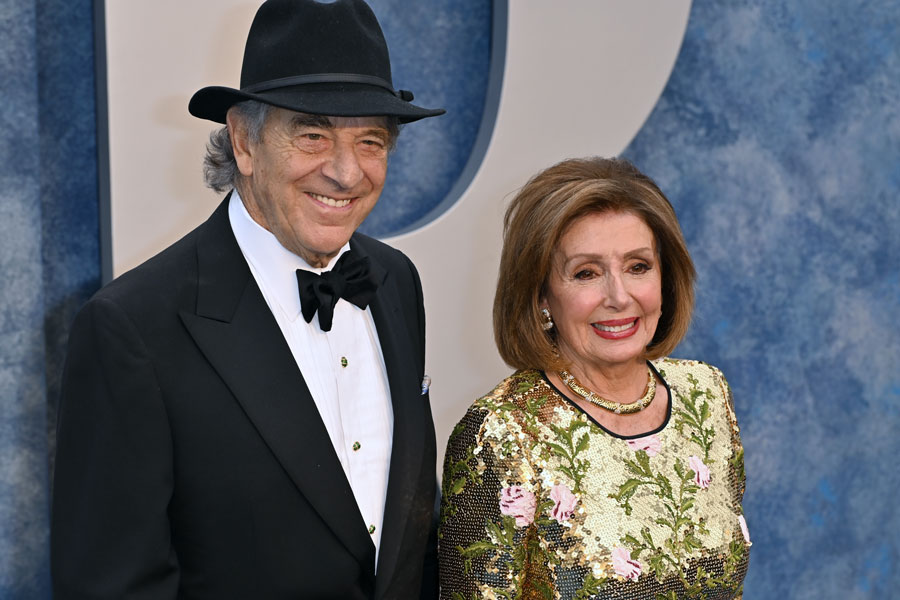

Paul Pelosi, Nancy’s husband who executes the trades, employed a sophisticated options-heavy strategy focused primarily on technology giants and artificial intelligence companies. His approach involves purchasing deep in-the-money call options with extended expiration dates, providing leveraged exposure to stock price movements while limiting downside risk.

Key 2024 Trades:

- NVIDIA Corporation: Multiple strategic transactions including exercising 500 call options in December 2024 at a $12 strike price, while simultaneously selling 10,000 shares and purchasing 50 new call options with an $80 strike expiring in January 2026.

- Apple Inc.: Executed a major exit by selling 31,600 shares on December 31, 2024, valued between $5-25 million – notably timed before Apple’s subsequent 8% decline.

- Alphabet and Amazon: Purchased 50 call options each with $150 strike prices expiring January 2026, positioning for continued tech sector growth.

- Emerging AI Plays: Invested in Tempus AI through 50 call options, which surged nearly 60% following the disclosure. Also purchased Vistra Corp options, which gained over 33% shortly after.

Hedge Fund Performance Context

The hedge fund industry had its strongest year since 2009, with the top-performing strategies averaging 11.3% returns. However, even the best-performing individual hedge funds fell short of Pelosi’s results. According to LCH Investments data, the top 20 hedge fund managers collectively generated $93.7 billion in profits with asset-weighted returns of 13.1%, still significantly below Pelosi’s performance.

Leading hedge funds by assets under management like Citadel ($397 billion AUM), Millennium Management ($218 billion AUM), and Bridgewater Associates ($120 billion AUM) delivered solid but more modest returns. Multi-strategy funds, which performed best among hedge fund categories with 13.6% average returns, were still outpaced by substantial margins.

Timing and Information Advantages

The exceptional performance raises questions about the information advantages available to congressional members. Pelosi’s trades often demonstrate prescient timing around market-moving events and policy developments. Her investment in Tempus AI, for example, coincided with the company’s major announcement of a health concierge app, leading to significant stock appreciation.

The couple’s investment strategy focuses heavily on sectors directly impacted by congressional legislation and policy decisions, including technology regulation, healthcare policy, and energy infrastructure. This positioning provides potential advantages through early insights into regulatory developments and government spending priorities.

Financial Impact and Wealth Accumulation

The remarkable returns contributed to substantial wealth accumulation. The Pelosis’ estimated net worth increased from $370 million in 2023 to approximately $413 million in 2024, representing gains of $43 million despite Nancy’s congressional salary of only $174,000 annually.

Market analytics firm Quiver Quantitative estimates their stock portfolio alone at $133.7 million, with holdings concentrated in major technology companies including Apple, Amazon, Google, and NVIDIA. The couple’s wealth extends beyond public stocks to include a Napa Valley winery, political consulting firm ownership, and Bay Area restaurant investments.

Regulatory and Ethical Implications

The performance has reignited debates about congressional stock trading restrictions. The proposed PELOSI Act (Preventing Elected Leaders from Owning Securities and Investments Act) would require lawmakers to divest individual stocks or place them in blind trusts within six months of taking office. The legislation extends to spouses but excludes children from trading restrictions.

Current regulations require disclosure of trades within 45 days, creating opportunities for copycat investing through platforms like Autopilot, which has facilitated over $325 million in trades replicating the Pelosi strategy. The success of these tracking platforms demonstrates the significant market interest in congressional trading patterns.

The combination of exceptional returns, strategic timing, and potential information advantages continues to fuel discussions about the appropriateness of active stock trading by elected officials and their families, particularly when performance consistently exceeds professional money managers with decades of experience and sophisticated analytical resources.

Enforcement Challenges and STOCK Act Violations

Despite the regulatory framework, enforcement of congressional trading rules remains problematic. No member of Congress has ever been prosecuted for insider trading under the STOCK Act, despite widespread violations. Research by Business Insider found that 78 members of the 117th Congress violated the STOCK Act’s disclosure requirements, with violations typically resulting in minimal $200 fines that pose little deterrent effect.

The House Ethics Committee has recently increased scrutiny, as evidenced by the July 2025 report rebuking Representative Mike Kelly (R-PA) for his wife’s Cleveland-Cliffs stock purchase that coincided with his advocacy for the company. This case demonstrates the ongoing challenges in preventing the appearance of impropriety in congressional trading.

Copycat Investment Platforms and Market Impact

The success of Pelosi’s trading strategy has spawned a cottage industry of mimicry platforms. The Autopilot investment app has facilitated over $500 million in total investments, with more than $55 million specifically copying congressional portfolios. The platform allows users to automatically replicate trades disclosed by politicians, though with significant delays due to the 45-day disclosure requirement.

Trading platforms like Autopilot, NANC ETF, and various tracking websites demonstrate the substantial market interest in congressional trading patterns. These platforms have processed over 9 million trades and connected $6 billion in assets, highlighting the scale of retail investor interest in political trading strategies.

Broader Congressional Trading Context

Pelosi’s performance, while exceptional, occurs within a broader pattern of congressional outperformance. According to Unusual Whales’ 2024 analysis, Democratic lawmakers averaged 31% returns while Republicans achieved 26% gains, both substantially exceeding the S&P 500’s 24.9% return. This systematic outperformance across party lines suggests structural advantages available to all congressional members.

Other notable congressional traders include Representatives Marjorie Taylor Greene, whose Tesla investments surged alongside Elon Musk’s advisory role, and Cleo Fields, who has emerged as one of the most active traders with over $4 million in recent transactions. These examples illustrate that exceptional returns are not unique to Pelosi but represent a broader phenomenon.

Recent Controversies and Specific Trade Scrutiny

Several 2024 trades have drawn particular scrutiny for their timing relative to regulatory actions. The July 2024 sale of 2,000 Visa shares worth $500,000-$1 million occurred just two months before the Department of Justice filed an antitrust lawsuit against the company. Similarly, Microsoft stock sales preceded FTC antitrust reviews, raising questions about the timing of these transactions.

The couple’s January 2025 investment in Tempus AI through call options proved particularly prescient when the company announced a $200 million deal with AstraZeneca, causing the stock to surge 60%. Such precisely timed investments continue to fuel debates about information advantages.

Technological and Market Evolution

The democratization of congressional trade tracking through technology platforms represents a significant shift in how retail investors access political trading information. Advanced tracking systems now provide real-time updates on congressional portfolios, with some platforms offering algorithmic trading based on political disclosures.

This technological evolution has created a feedback loop where congressional trades can trigger substantial retail investor activity, potentially amplifying market impacts beyond the original political investment. The phenomenon raises new questions about market manipulation and the unintended consequences of transparency requirements.

International and Historical Perspective

The level of returns achieved by Pelosi and other congressional members is unprecedented in democratic systems worldwide. Most other developed nations either prohibit or severely restrict political officials from individual stock trading, making the American approach increasingly anomalous in international governance standards.

The historical context shows that even legendary investors like Warren Buffett’s average annual returns of 19.9% over six decades pale in comparison to the systematic outperformance demonstrated by congressional members, suggesting structural advantages that extend beyond individual skill or market knowledge.