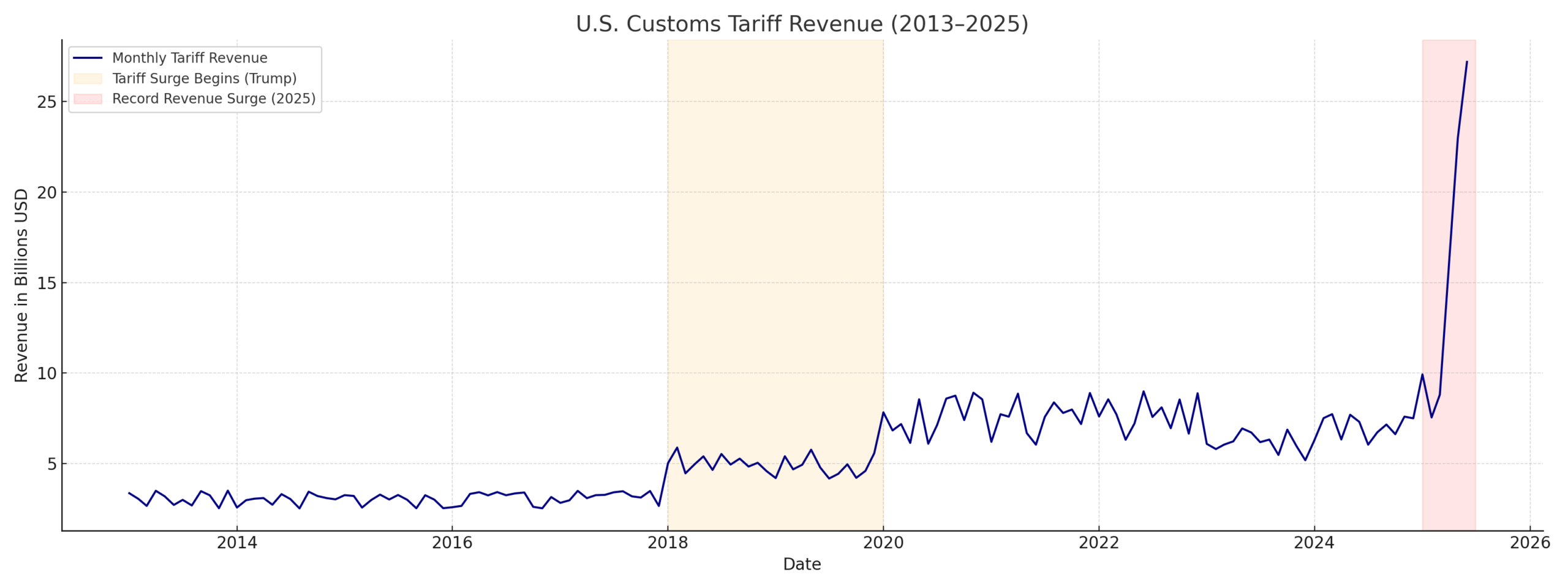

WASHINGTON, D.C. – The United States is raking in unprecedented sums from tariffs in 2025, with customs duties now contributing a larger share to the federal budget than at any point in modern history. Recent Treasury data shows that revenue from tariffs and import duties has surged month after month, with June alone bringing in over $27 billion – shattering prior records.

For years, tariffs taxes levied on imported goods accounted for only a small fraction of federal income, typically generating between $30 billion and $40 billion annually. That changed sharply after 2018 when then-President Donald Trump implemented sweeping trade measures, targeting steel, aluminum, and hundreds of billions worth of Chinese goods. Tariff collections rose significantly during his first term but dipped somewhat under President Joe Biden as some duties were eased or paused.

Now, in what many are calling “Tariff 2.0,” the numbers are climbing again.

In April 2025, the U.S. government collected more than $16 billion in customs duties, followed by $23 billion in May and $27.2 billion in June, according to monthly budget reports from the U.S. Treasury. Year-to-date figures suggest the country is on track to collect more in customs revenue in 2025 than in any other fiscal year – even surpassing the previous high of $108 billion in 2022.

The surge in revenue is largely driven by newly enacted tariffs in 2025 that impose significantly higher duties on select imports, particularly from China. The White House has defended the moves as part of a broader strategy to protect American manufacturing and reduce reliance on foreign supply chains. Some economists warn that the increased costs will ultimately be passed on to consumers and businesses in the form of higher prices.

Nevertheless, the fiscal impact is undeniable. Tariff income, once an afterthought in the context of trillion-dollar budgets, has become a notable revenue stream. In June, tariff collections alone contributed to a surprise $27 billion federal surplus, offsetting deficits in other areas.

Fiscal analysts note that this shift represents not only a policy choice but a potentially volatile source of income. Tariff revenue depends on both the volume of goods imported and the willingness of trading partners to accept or retaliate against new levies. Several major U.S. trading partners have already begun pushing back diplomatically, signaling the potential for renewed trade tensions.

Still, the numbers speak for themselves: through the first nine months of the 2025 fiscal year, the federal government has collected more than $113 billion in gross customs duties — nearly double the amount collected during the same period last year.

Whether the trend will continue, or face legal and political challenges, remains to be seen. But for now, tariffs are back, and bringing in more money than ever.

Top Questions On Record-Breaking U.S. Tariff Revenue Surge

Q: Why is the U.S. collecting so much tariff revenue in 2025?

A: The surge is primarily driven by new and expanded tariffs introduced in early 2025, particularly on imported goods from countries like China. These measures are designed to encourage domestic manufacturing and create a more balanced trade environment – and they’re bringing in record levels of customs revenue as a result.

Q: How much tariff money has the U.S. brought in this year?

A: In just the first nine months of the 2025 fiscal year, the U.S. government has collected over $113 billion in gross customs duties – a dramatic increase from the same period last year and already enough to match or exceed any full year on record

Q: What were the biggest months for tariff collections in 2025?

A: April, May, and June were the standout months. In April, the U.S. took in about $16 billion, followed by $23 billion in May, and an unprecedented $27.2 billion in June, helping drive a surprise federal budget surplus that month.

Q: Where does this tariff money go?

A: Tariff revenue is deposited directly into the U.S. Treasury and helps fund federal programs, infrastructure, defense, and debt obligations. In 2025, it’s playing a notable role in offsetting budget deficits and strengthening the country’s fiscal position.

Q: Does this mean tariffs are good for the economy?

A: While tariffs can increase costs for importers, the current policy is intended to strike a balance between protecting U.S. industries and generating revenue. Supporters say the surge in collections proves tariffs can be an effective economic tool when implemented strategically.

Q: How does 2025 compare to other years in terms of tariff revenue?

A: It’s not even close. Prior to 2018, annual customs collections were typically under $40 billion. The last major peak was in 2022 at around $108 billion. But 2025 has already surpassed that — and the year isn’t over yet.

Q: Are American taxpayers paying for these tariffs?

A: Tariffs are paid by importers, not directly by taxpayers. While there can be downstream effects on consumer prices, the revenue collected is a direct inflow to the federal government – not a new tax on individuals or businesses.