LONG ISLAND, NY – Homeowners across Long Island are finding themselves in a uniquely favorable position as the region’s real estate market continues to tilt in their favor midway through 2025. Prices are climbing steadily in both Nassau and Suffolk counties, while overall housing supply remains tight – setting the stage for a competitive market environment that benefits well-positioned sellers.

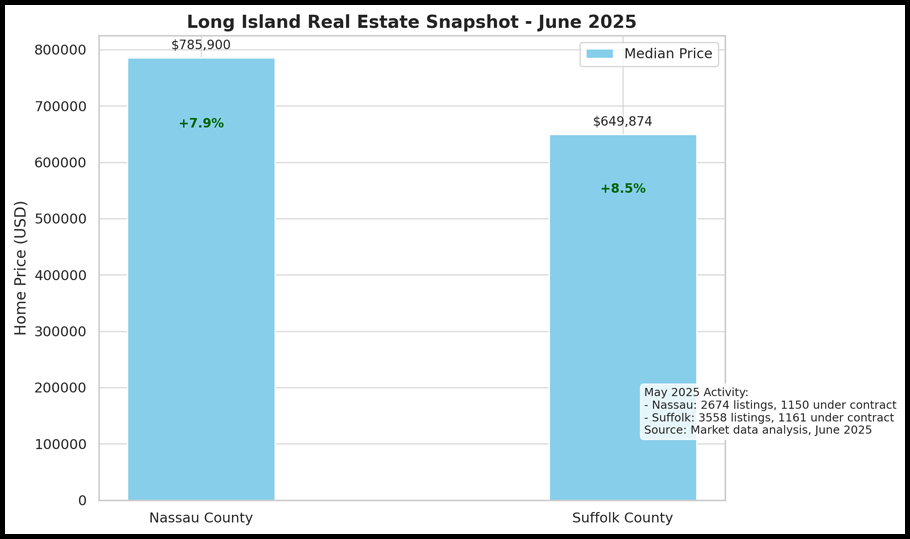

Recent data from Nassau County shows median home prices hovering near $785,000, with Suffolk County not far behind at approximately $649,000. Year-over-year increases have reached 7–8%, with even sharper gains reported in the first quarter of the year. Meanwhile, homes in desirable price bands – such as $650,000 to $850,000 in Nassau and $600,000 to $700,000 in Suffolk a- re attracting swift offers, often within weeks of listing.

Despite some hesitation driven by higher mortgage rates, buyer activity has held steady. In May alone, over 2,300 homes went under contract across Long Island, mirroring figures from the same period last year. This indicates that demand has not weakened even as borrowing costs remain near 7%.

An increase in active listings – up about 15% month-over-month s- uggests that more homeowners are beginning to test the market. However, inventory is still historically low compared to pre-pandemic norms, with many potential sellers choosing to hold onto ultra-low mortgage rates secured in previous years.

In several local markets, conditions vary. Areas like Brookhaven are seeing strong investor and rental demand, while towns such as Huntington and North Hempstead continue to support higher-end home values, though luxury properties are turning over more slowly.

According to local real estate professionals tracking the market closely, sellers who are considering downsizing, relocating, or divesting from inherited or investment properties may find this summer an ideal window to act. Homes that are appropriately priced and professionally marketed continue to draw buyer interest despite broader economic caution.

This snapshot of the Long Island real estate market reflects insights gathered from recent housing reports and regional experts specializing in residential trends.

Q&A: What’s Happening in the Long Island Real Estate Market in 2025?

Q: Are home prices on Long Island still rising?

A: Yes. As of June 2025, median home prices in Nassau County are approximately $785,900, and in Suffolk County about $649,874. That reflects a 7.9% increase in Nassau and an 8.5% increase in Suffolk year-over-year. Earlier in Q1 2025, Nassau even saw gains of over 21% from the previous year.

Q: Is inventory growing, or are homes still hard to find?

A: Inventory has grown modestly but remains historically tight. As of May 2025, there were about 6,232 active listings on Long Island—up 14.6% from the prior month, but still 1.3% below the number of homes listed a year ago.

- Nassau County had roughly 2,674 listings.

- Suffolk County had about 3,558 homes on the market.

Q: How is buyer demand holding up with higher mortgage rates?

A: Demand remains steady despite rates nearing 7%. In May 2025, there were approximately 2,311 homes under contract, nearly identical to May 2024 levels. Nassau County saw a 5% increase in home sales during the first quarter compared to the year before, indicating resilient buyer interest.

Q: What are typical mortgage rates right now?

A: As of mid-2025:

- 30-year fixed rate: ~6.73%

- APR average: ~6.85%

These rates are slightly lower than last year but still high enough to impact affordability—especially for first-time buyers or those trying to upgrade.

Q: What’s the “rate lock” effect, and how is it impacting sellers?

A: Many homeowners are reluctant to sell because they currently have mortgage rates below 4%. This phenomenon – often called the “rate lock” – is keeping inventory lower than it might be otherwise, even as prices rise and buyer demand stays high.

Q: Are there differences between Long Island submarkets?

A: Yes. Each area is performing differently:

- Hempstead: Median ~$680K, ~39 days on market.

- Brookhaven: ~$540K, strong rental and investor demand.

- Huntington: ~$775K, higher-end homes selling slower.

- Islip: ~$595K, steady demand from family buyers.

- Commack/North Hempstead: $685K–$875K, low turnover rates.

Q: Who are the ideal sellers in today’s market?

A: Sellers likely to benefit most right now include:

- Those with inherited homes.

- Landlords exiting the rental market.

- Homeowners facing foreclosure or seeking to downsize.

- Families planning to relocate out of state or retire.

Q: Are homes selling quickly?

A: Yes, especially in the $600K–$850K range. Homes that are well-priced and staged properly are often receiving offers within 2–3 weeks of hitting the market.

Q: Is this a good time to sell?

A: For many, yes. Rising home values, steady demand, and still-limited competition present a strong opportunity. However, this window may narrow if more inventory floods the market or if interest rates climb again in late 2025.