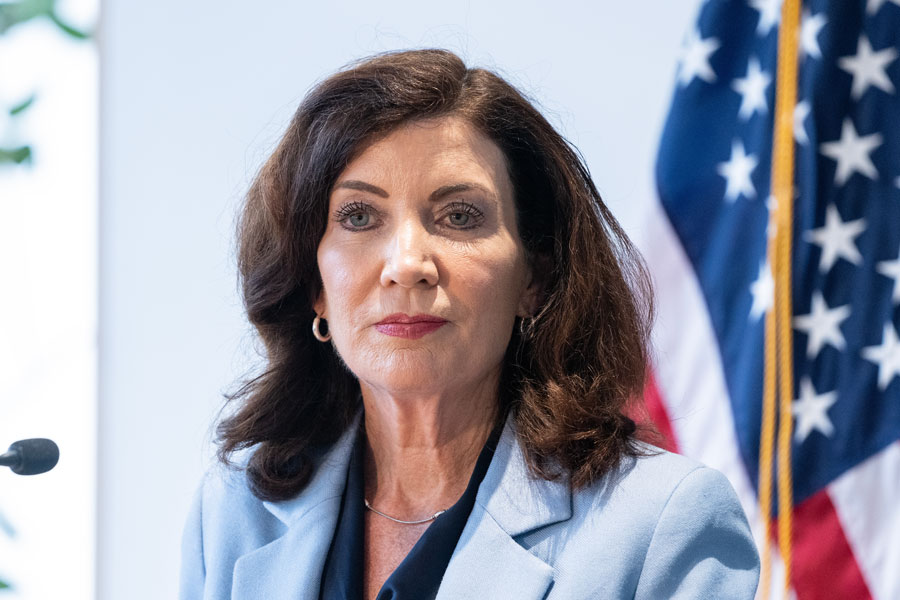

ALBANY, NY – New York Governor Kathy Hochul has announced a new round of direct payments aimed at helping residents cope with inflation – but critics say the so-called “Inflation Refund” checks may offer more political optics than practical relief.

As part of the 2025–2026 state budget, the plan will send one-time payments of up to $400 to qualifying households this fall. The funding – roughly $2 billion in total – comes from surplus sales tax revenue the state collected amid rising consumer prices.

The payments are structured by income and filing status:

- Single filers earning:

- $75,000 or less will receive $200

- $75,001 to $150,000 will receive $150

- Married couples filing jointly earning:

- $150,000 or less will receive $400

- $150,001 to $300,000 will receive $300

Roughly 8.2 million households across New York State will automatically receive a check between mid-October and late November 2025. No application is required – payments will be sent to the most recent mailing address listed on each filer’s 2023 state tax return.

Hochul said the checks are designed to offer “immediate relief for working and middle-class families,” especially those who’ve felt squeezed by rising costs at the pump, grocery store, and utility counter.

But for many New Yorkers, the math doesn’t add up.

With grocery bills up 20% in the past two years and rents climbing faster than wages, $200 barely scratches the surface,” said a consumer advocate in Albany. “It feels more like a symbolic gesture than real economic support.”

According to the New York State Department of Taxation and Finance, the program is funded from a sales tax windfall created by higher prices – meaning consumers have already effectively paid into the pool by spending more for basic goods and services.

The refund checks are just one part of a larger affordability package included in the state budget. The plan also features:

- An expansion of the Empire State Child Credit

- Universal free school meals for public K–12 students

- The largest middle-class tax cut in 70 years

Still, some lawmakers have criticized the one-time nature of the refund checks, questioning whether they are more about political messaging ahead of a 2026 election cycle than lasting financial relief.

There’s no doubt people are hurting,” said one state legislator who asked not to be named. “But cutting a one-time check that doesn’t even cover a single utility bill isn’t going to change anyone’s economic reality.”

Others argue that while limited in scope, the payments could still provide some breathing room for families living paycheck to paycheck.

The Hochul administration maintains that the Inflation Refund is part of a multi-pronged effort to ease cost-of-living pressures, and that broader tax relief measures will continue into 2026 and beyond.

Eligible residents are encouraged to ensure their mailing address is up to date with the Department of Taxation and Finance to avoid delays.

For more information on eligibility and distribution, visit https://www.tax.ny.gov/pit/inflation-refund-checks.htm

Top Questions About New York’s Inflation Refund Checks

What are the New York Inflation Refund checks?

They are one-time payments being issued by the state of New York in Fall 2025 to help offset the impact of inflation. The payments are part of the 2025–2026 state budget and funded by surplus sales tax revenue.

Who is eligible to receive a check?

Eligible recipients must have filed a 2023 New York State tax return (Form IT-201), have been a full-year New York resident in 2023, not have been claimed as a dependent on someone else’s return, and meet certain income thresholds.

How much is the payment?

Exact amounts depend on income and filing status. Single filers earning up to $75,000 will receive $200; those earning between $75,001 and $150,000 will receive $150. Married couples filing jointly earning up to $150,000 will receive $400; those earning between $150,001 and $300,000 will receive $300.

Do I need to apply to get the refund?

No. If you’re eligible, the check will be mailed automatically to the address on your 2023 tax return. There’s no separate application or form to fill out.

When will the checks be sent?

Refund checks will begin mailing in mid-October 2025 and continue through late November 2025.

How will I receive my payment?

Payments will be sent as physical checks by mail. Direct deposit is not being used for this particular refund.

What is the refund funded by?

The payments are funded by surplus sales tax revenue collected by the state during periods of high inflation, when consumers paid more in taxes due to higher prices.

Will this affect my 2025 taxes?

No. The refund is not considered taxable income for either state or federal purposes, according to the New York State Department of Taxation and Finance.

What if I moved since filing my 2023 return?

If your mailing address has changed, you should update it with the New York State Department of Taxation and Finance as soon as possible to avoid delays or lost checks.

Is this part of a larger relief program?

Yes. The Inflation Refund is one component of a broader affordability package that includes expansion of the Empire State Child Credit, universal free school meals, and the largest middle-class income tax cut in state history.